- Section 1: Why Buy a Business Instead of Starting from Scratch?

- Section 2: The Process of Buying a Shopify Business

- Deciding on the Stage of the Business You Want to Buy

- Finding Reliable Sources for Businesses Sale

- Browsing Listings and Initial Screening

- Assessing the Value and Potential of a Business

- Making an Offer and Negotiating the Deal Terms

- Conducting Due Diligence to Verify the Business’s Health

- Finalizing the Purchase Agreement

- Completing the Ownership Transfer

- Section 3: Key Considerations Before Buying a Shopify Business

- Section 4: Finding the Right Shopify Business to Buy

- Section 5: Evaluating the Value of a Shopify Business

- Section 6: Negotiating the Best Price and Terms for Your Acquisition

- Section 7: Mitigating Risks Through Effective Due Diligence

- Section 8: Financing Your Shopify Business Acquisition

- Section 9: Finalizing the Purchase and Transitioning as the New Owner

- Section 10: Conclusion

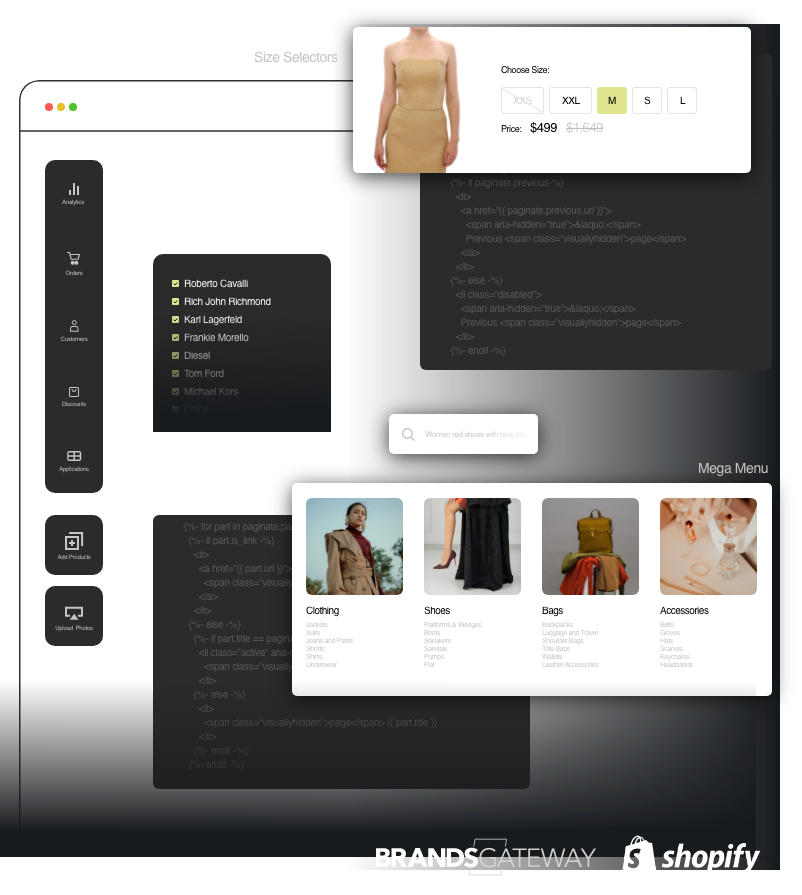

A Shopify business is an online store powered by the popular e-commerce platform, Shopify. Many entrepreneurs are choosing this option because of its potential to make money. This guide will give you all the information you need about buying a Shopify business.

The idea is simple: instead of starting from scratch, why not buy a store that’s already set up? Pre-built Shopify stores give you a head start in the competitive world of online selling. They have many benefits, including:

- A ready-to-go customer base who are interested in buying what you offer

- The ability to start selling right away

- Products that have already proven to be popular with customers

In this guide, we’ll go through everything you need to know about buying a Shopify business:

- Why it’s often better to buy a business instead of starting one from scratch

- How to find and choose the right business to buy

- The steps involved in making the purchase

- What to do after you’ve become the new owner

We’ll also talk about some important things to think about before making a decision and how to evaluate if a business is worth buying.

By reading this guide, you’re starting an exciting journey – one that could lead to owning a successful Shopify business! Let’s begin.

Note: If you’re interested in exploring some pre-built Shopify stores available for sale right now, I recommend checking out Lemon.dev’s fully built Liv Theme. It’s a great resource for finding high-quality businesses that suit your interests and goals.

Section 1: Why Buy a Business Instead of Starting from Scratch?

When you’re thinking about becoming an entrepreneur, one of the big decisions you’ll have to make is whether to buy an existing business or start one from scratch. There are some clear advantages to choosing to purchase an already established Shopify store:

- Immediate Market Entry: When you acquire a ready-made Shopify business, you can jump right into running it. This gives you a significant advantage over the long and difficult process of building a brand-new store.

- Direct Revenue Potential: An existing store usually comes with financial records showing how much money it’s making. As a business owner, this lets you see right away how profitable the business could be.

- Accelerated Growth: One of the most valuable things about buying an established business is that it already has customers. With people already buying from the store, it’s much easier and faster to grow compared to starting from scratch and trying to attract your first customers.

By purchasing an existing Shopify store, entrepreneurs can avoid common challenges like creating a brand and finding customers. Instead, they can focus on growing the business immediately.

Section 2: The Process of Buying a Shopify Business

Acquiring a Shopify business involves a systematic approach. Let’s dive into the eight key steps to buy a Shopify business, shedding light on what each stage entails.

-

Deciding on the Stage of the Business You Want to Buy

A new Shopify store offers flexibility to shape it according to your vision, while an established one brings an existing customer base and revenue flow. Your choice depends on your business goals and risk tolerance.

-

Finding Reliable Sources for Businesses Sale

Utilize reputable online marketplaces or business brokers to browse potential acquisitions.

-

Browsing Listings and Initial Screening

Filter businesses based on industry, location, price, and profitability to find potential matches.

-

Assessing the Value and Potential of a Business

This includes reviewing financial records, traffic sources, customer base, and growth potential. You might want professional help from a Certified Public Accountant (CPA) or Accredited Senior Appraiser (ASA).

-

Making an Offer and Negotiating the Deal Terms

Base your offer on the valuation results and be ready for negotiations about price and payment terms.

-

Conducting Due Diligence to Verify the Business’s Health

Thoroughly inspect all aspects of the business including legal documents, contracts, financial statements, sales data, etc.

-

Finalizing the Purchase Agreement

Once due diligence is complete and you’re satisfied with the results, it’s time to formalize the transaction with a purchase agreement.

-

Completing the Ownership Transfer

Funds are placed in escrow until the closing date when ownership is transferred.

These steps provide a road map for acquiring your desired Shopify store.

Section 3: Key Considerations Before Buying a Shopify Business

Before you start exploring the Shopify marketplace, it’s important to take some time for self-reflection. Ask yourself these questions:

- Do you know what you like and are good at?

- Are those things aligned with what it takes to run an online business?

Understanding your preferences, strengths, and how they fit into the world of e-commerce is crucial. This will help you determine if you’re ready for the challenges ahead and if they match your skillset.

Understanding the Lifestyle Change Involved in Owning an Established Business

When you buy an established business on Shopify, you’re essentially stepping into someone else’s shoes and taking over their operations. This means you’ll be responsible for things like:

- Dealing with customers

- Managing product shipments

- Coming up with plans for growth

It’s important to be aware of these responsibilities and decide if you’re ready to handle them.

Weighing the Pros and Cons of Buying an Existing Shopify Store versus a Startup

As you consider whether to buy an existing Shopify store or start your own from scratch, here are some factors to think about:

- Pros of buying an existing store:You get immediate access to a market that already knows about the store.

- There’s already a base of customers who have purchased from the store before.

- The store likely has systems in place for things like order fulfillment and inventory management.

- Cons of buying an existing store:The upfront cost of buying a store might be higher compared to starting from nothing.

- You could end up inheriting any problems or negative reputation associated with the store.

The decision between buying an existing business or starting one yourself should be based on two things:

- How ready are you to jump right into the day-to-day activities of a business?

- Are you comfortable dealing with the complexities that come with taking over an established entity?

Understanding whether you enjoy building a brand from the ground up or prefer working with a concept that’s already proven successful will help guide your decision-making process.

Section 4: Finding the Right Shopify Business to Buy

Finding the right Shopify business to buy requires a strategic approach. There are various sources to explore when on the hunt for the ideal business acquisition.

-

Working With Brokers to Access Exclusive Listings

Brokers can be a valuable resource when finding businesses for sale. They often have access to exclusive listings that aren’t available on public marketplaces. By building a relationship with a broker, you can gain access to these hidden gems and get expert advice on which businesses best suit your goals and skills.

-

Top Online Marketplaces for Buying Shopify Businesses

Aside from brokers, there are several online marketplaces where owners list their Shopify businesses for sale. Platforms like BizBuySell, Exchange Marketplace, and Flippa specialize in digital businesses including Shopify stores. These platforms offer detailed information about each listing, allowing you to sift through multiple options until you find one that meets your criteria.

Remember, whether you choose to work with a broker or browse online marketplaces, due diligence is key. In the next section, we will delve into evaluating the value of a Shopify business – an essential step before making any purchasing decision.

Section 5: Evaluating the Value of a Shopify Business

Evaluating the value of a Shopify business is a crucial step before making an acquisition. Two prevalent methods are income-based valuation and asset-based valuation.

Income-Based Valuation

This technique primarily considers the business’s profitability. It includes metrics like net income, cash flow, and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). A common approach here is the Multiple of Seller’s Discretionary Earnings method. It involves multiplying the seller’s discretionary income by an industry-specific multiplier.

Asset-Based Valuation

This method focuses on the tangible and intangible assets of the Shopify store. Tangible assets include inventory and equipment, while intangible assets can be brand recognition, customer base, and intellectual property.

Keep in mind that valuing a business is not solely about numbers; other key factors play a role:

- Historical Performance: Check past sales data, profit margins, and growth trends.

- Market Position: Analyze the competitive landscape and market share.

- Customer Base: Evaluate customer loyalty, retention rates, and cost of customer acquisition.

Remember to engage professionals like Business Brokers or Certified Public Accountants for accurate valuation.

Section 6: Negotiating the Best Price and Terms for Your Acquisition

In the world of acquisitions, a successful negotiation process is key. To achieve a win-win outcome, it’s crucial to build a strong rapport with the seller. This involves open communication and demonstrating your sincere interest in their Shopify business.

When you approach sellers, avoid lowball offers as this can be disrespectful and harm the seller dialogue. Instead, base your offer on your comprehensive understanding of the business from your due diligence findings.

Here are a few tips to guide you through the negotiation process:

- Establish trust: Show that you’re serious about the acquisition by being transparent about your intentions and financial capabilities.

- Use due diligence as leverage: The information obtained during due diligence can be used to negotiate better terms. For instance, if there’s a significant risk identified, you could argue for a lower price or better payment terms.

- Be flexible: Understand that negotiation is a give-and-take process. Be willing to compromise on some aspects but remain firm on your deal-breakers.

Remember, the goal is not just to buy the Shopify business but also to maintain a positive relationship with the seller post-acquisition, especially during the transition period.

Section 7: Mitigating Risks Through Effective Due Diligence

Thorough due diligence is the cornerstone of a secure Shopify business acquisition. It serves as a safeguard against unforeseen issues, enabling you to make an informed decision. Here are the essential components:

Examining Key Legal Documents and Contracts

- Compliance: Ensure all business operations comply with legal standards.

- Agreements: Review supplier, lease, and customer contracts for liabilities.

- Intellectual Property: Verify ownership of logos, domain names, and trademarks.

Analyzing Financial Performance Through Detailed Statements

- Profitability: Scrutinize profit and loss statements for economic viability.

- Balance Sheets: Assess financial health by reviewing assets and liabilities.

- Cash Flow: Understand the liquidity and operational efficiency through cash flow analysis.

Verifying the Accuracy of Reported Sales Data

- Revenue Verification: Cross-reference reported sales with actual bank statements.

- Customer Metrics Evaluation: Dive into customer retention rates and lifetime value analysis to gauge business stability.

By meticulously examining these areas, you position yourself to navigate away from potential pitfalls associated with purchasing a Shopify business.

Section 8: Financing Your Shopify Business Acquisition

Securing the capital to purchase a Shopify business is a critical step in the acquisition process. Entrepreneurs have access to various financing options that cater to different needs and circumstances. Understanding and choosing the right one can make all the difference in facilitating a successful transaction.

Traditional Lending Options

Bank Loans

- Start with local banks where you already have a relationship

- Be prepared with a solid business plan and financial projections

- Expect to provide collateral for securing the loan

SBA Loans

- Offered by banks but guaranteed by the Small Business Administration (SBA)

- Typically lower interest rates and longer repayment terms

- Requires meeting SBA eligibility criteria

Creative Financing Solutions for E-Commerce Entrepreneurs

Seller Financing Arrangements

- The seller acts as the lender, allowing payments over time

- Usually involves down payment followed by installment payments with interest

- Can be negotiated based on terms like duration and interest rates

Exploring these options requires a clear understanding of your financial position and an assessment of risk tolerance. Each financing path comes with its own set of requirements, benefits, and limitations. Diligent preparation and negotiation can lead to favorable terms that support your entrepreneurial goals within the e-commerce landscape.

Section 9: Finalizing the Purchase and Transitioning as the New Owner

Once you’ve gone through the negotiation process and both parties have agreed on the terms, it’s time to make the deal official with a purchase agreement. This legal document covers all aspects of the sale, such as payment terms, assets being transferred, and any warranties or indemnifications. It acts as a guide for the ownership transfer and protects both the buyer and seller by clearly stating what is expected.

Using a Purchase Agreement to Formalize the Transaction

Here are the steps involved in using a purchase agreement to formalize the transaction:

- Drafting the Document: Work with a business attorney to create a thorough purchase agreement. This will ensure that all legal requirements are met and that you fully understand each part of it.

- Review and Sign-off: Both parties should carefully review the purchase agreement. Once you have confirmed that all the terms are accurate and fair, you can proceed with signing it.

- Ownership Transfer Steps:

- Register the change in ownership with Shopify and any other relevant platforms or services.

- Update your bank account details and other financial information as necessary.

- Transfer ownership of domain names, social media accounts, and any other digital assets included in the sale.

- Inform your vendors, suppliers, and employees about the upcoming change in ownership.

By following these steps in a systematic manner, you will lay a strong foundation for successfully transitioning into your new role as a Shopify business owner.

Section 10: Conclusion

The world of e-commerce is full of potential, and acquiring a Shopify business presents an attractive opportunity. It’s time to put your entrepreneurial spirit to work and explore the possibilities.

Remember the distinct advantages of opting for a pre-built store:

- Immediate market entry: No need to navigate the startup phase or break-in period. You can commence operations right away.

- Existing customer base support: Profit from a built-in audience who are already familiar with and loyal to the brand.

So, step into the shoes of a business owner, evaluate your prospects with due diligence, negotiate your terms, and embark on this exciting journey. Aim high, achieve higher!

Embrace this unique path towards entrepreneurship and make your mark in the online marketplace by getting a pre-built Shopify store.